Limited Liability Partnership LLP General Partnership. An LLP or a Sdn Bhd please feel free to contact us.

Covid 19 Create New Income G A Group

Bhd As many might know most Malaysia n prefer to incorporate a sole proprietorship compared to a private limited Company Sdn.

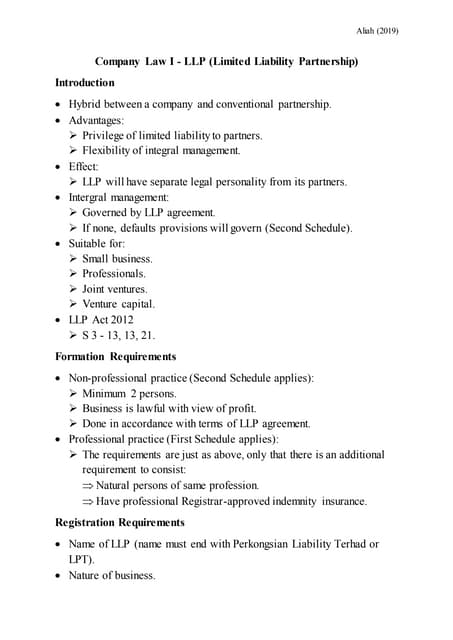

. About Program Sdn Bhd and LLP are two of the most popular business type for startups and entrepreneurs. In a Small Business Partnership the tax rate for all the shareholders is RM 10900 for the first 100000. Capital Contribution Share Capital Partners contribution Owners of the Business Shareholders LLP Partners Personal Liability No No Legal Status Separate Legal Entity Separate Legal Entity Party that is liable for debts of the business Company LLP Responsibility for management of business Directors.

We have noticed an unusual activity from your IP 1575539127 and blocked access to this website. Still easier to use than a Sdn Bhd. He may make use of the.

There are 8 types of business entities for entrepreneurs to register in Malaysia with private limited company Sdn Bhd being one of the most common ones. But LLP is not well recognised by bank so it may face difficulties to get loan. Sdn Bhd Private Limited Company Sole Proprietorship Partnership.

The savings are mainly because of the lesser government fees for forming an LLP RM500 versus government fees for forming a Sdn Bhd RM1250. Bhdare entitled for more tax incentives. When can start busines.

With the introduction of a new business vehicle by Companies Commission of Malaysia we thought it might be worthwhile to come up with a comparative table that will briefly explain the significant differences between each business entities available in Malaysia. Company name ended with the word Sdn Bhd or Bhd. If you are a Malaysian citizen or permanent resident thinking of starting a small business on your own a sole proprietorship is one of the simplest business entities to consider in Malaysia.

Now its a good opportunity for you to learn more about SDN BHD and LLP. Characteristically there are major differences. LLP is like a Sdn.

Bhd Berhad Bhd Limited Liability Partnership LLP 1. 8 - 10 days. Totally agreed esp on the loan part.

Again the set-up and compliance costs for a. LLPs registration costs and on-going compliance costs are relatively cheaper due to fewer ongoing compliance requirements ie. Your personal wealth will be protected.

Then after that for the succeeding RM 100000 it will increase to 24. Please note that the information above is given without prejudice and users should seek professional assistance before relying on any of the information herein. Date 13 July 2022 Wed Time 400pm 500pm Venue Live on ZOOM Our Speaker.

RM100 RM2200 Ability to obtain loan. Your personal assets wealth will be jeopardized due to risks exposed in your business. Provide the name of the enterprise the nature of the business the address of the registered office the name and details of the partners the name and details of the compliance officer and the approval letter of the professional body if any.

The LLP has more compliance requirements than a conventional partnership but is yet again relatively less complex compared to the Sdn Bhd. Registering a business entity with the Companies Commission of Malaysia SSM is the first requirement to run a business legally in Malaysia. Besides legal liability private limited companies sdn bhd also differ from sole-proprietorships and partnerships when it comes to the accounting and auditing standards they would need to meet.

Lets say A and B are in an Shd Bdn company and both have invested a 5050 share of RM 500000 and A has an income. But without shareholders and directors only got partners. Personal assets wealth are protected.

Sole Proprietorship VS Private Limited Company Sdn. Join us and learn about the differences of Sdn Bhd and LLP and which one you should choose for your business journey. Professional fees may be lesser for forming an LLP due to a less complicated process compared to that for a Sdn Bhd.

Application steps for Private Limited Company Sendirian Berhad Sdn Bhd. Bhd and LLP provide you with personal liability protection and the tax treatments are generally the same except that Sdn. Overall the choice between using an LLP vs a Sdn Bhd depends on the entrepreneurs objectives.

There are 3 categories of business entity registration namely Registration. 20th April 2021 Tuesday 1100am -1200pm. It is mandatory for private limited companies to be audited by an accounting firm annually whereas there isnt such a requirement for sole-proprietorships and partnerships.

Limited Liability Partnership LLP was introduced by Companies Commission of Malaysia last year. The cost to operate a LLP is much lower than Sdn Bhd. Banks always prefer Sdn Bhd over LLP peace.

Your personal wealth may be affected exposed to risks. Choice of Trade Name subjected to ROB approval. Lets have an illustrative scenario about this.

Adam Teh and Lim Pei Hau of WeCorporate shared about the differences of business entities and what advantages you gain regarding liabilities accounting and. Company name ended with the word PLT Perkongsian Liabiliti Terhad Choice of Trade Name subjected to ROB approval. Please confirm that you are not a robot.

LLP is like an artificial person just like a Sdn. 24 hours shelf company 10 days new company Start up costs. You can take greater risks to gear up the growth of your business.

Limited Liability Partnership vs Sdn Bhd. Bhd due to the cheap cost and easy registration as well as cheaper cost to maintain the business annually. No compulsory on appointment of qualified secretary no statutory audit requirements and less.

Sole Proprietorship Vs Llp Vs Sdn Bhd Youtube

Ashton Corporate Services Company Secretary Klang Subang Jaya Home Facebook

Limited Liability Partnership Llp Registration In Malaysia

Sole Proprietorship Vs Llp Vs Sdn Bhd Youtube

Sole Proprietorship Vs Llp Vs Sdn Bhd Youtube